Find Out 25+ Truths Of Default Risk Premium Definition They Missed to Share You.

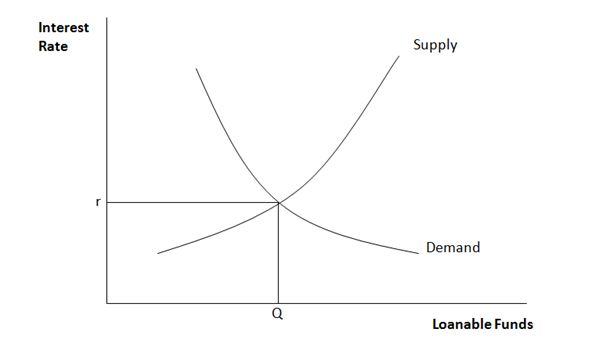

Default Risk Premium Definition | Risk premium is one of the most misunderstood concepts in. The formula for risk premium, sometimes referred to as default risk premium, is the the risk premium of the market is the average return on the market minus the risk free rate. If you are visiting our english version, and want to see definitions of default risk premium in other languages, please click the language menu on the right bottom. This is seen mainly in the bond market, where firms with a greater chance of default pay more interest on a bond than safer, more stable companies pay. It is the additional return that an investor requires to hold a risky asset rather than one that is risk free.

Default risk is the risk that a lender takes on in the chance that a borrower will be unable to make the required payments on their debt obligation. Default risk premium or (drp) represent the extra return that the borrower must pay the lender for assuming the extra or default risk. A default occurs when a company misses an interest payment to its bondholders, so a default risk premium is intended to offset this risk with higher interest payments. A default risk premium is built into every investment to cover this. Risk premiums are a good way to determine whether.

/dotdash_Final_How_Risk_Free_Is_the_Risk_Free_Rate_of_Return_Feb_2020-96f00395de3d40668f31522801756339.jpg)

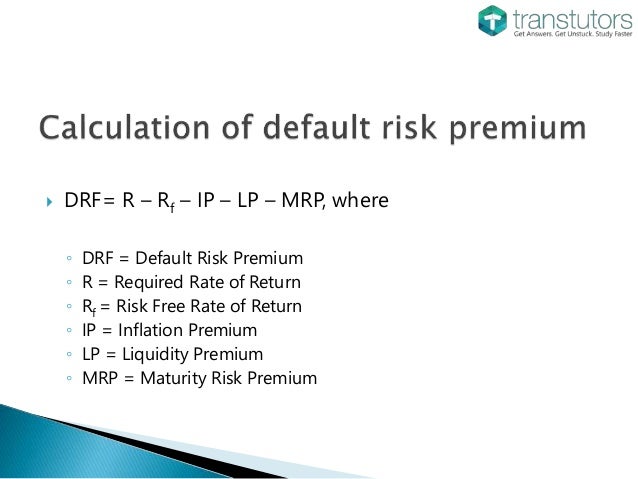

Risk premium calculator (click here or scroll down). Quizlet is the easiest way to study, practise and master what you're learning. Default risk premium or (drp) represent the extra return that the borrower must pay the lender for assuming the extra or default risk. This video explains the difficult concept of risk premium through a simple, relatable example. Where drp is the default risk premium. The capital asset pricing model is used to help. The expected devaluation rate and default risk premiums are given by ε and ρ, respectively, and r denotes the level of foreign exchange reserves. Default risk is the risk that a lender takes on in the chance that a borrower will be unable to make the required payments on their debt obligation. Create your own flashcards or choose from millions created by other to estimate the default risk premium, find the two investments that have the same maturity but different levels of default risk. They are listed on the left below. A default risk premium is built into every investment to cover this. Default risk premium definition and meaning: For example, the data necessary for its implementation are usually widely available at low cost, and its calculations are relatively simple.

This paper quantifies the premium demanded by the investors for bearing the corporate default risk. Quizlet is the easiest way to study, practise and master what you're learning. They end up paying a higher interest rate on loans, because there is a higher chance the bank won't get their money bank. What does risk premium mean? It is the additional return that an investor requires to hold a risky asset rather than one that is risk free.

The additional return lenders require to compensate them for default risk. Default risk premium is the component of a required interest rate that is based on the lenders' perceived risk of default. Default premium is the component of interest rate that is attributed to the risk of the borrower failing to pay back the principal. Where drp is the default risk premium. It can be estimated based on the difference between the if a certain liquidity premium exists it can be subtracted from the difference to arrive at a default risk premium. Quizlet is the easiest way to study, practise and master what you're learning. They end up paying a higher interest rate on loans, because there is a higher chance the bank won't get their money bank. If you are visiting our english version, and want to see definitions of default risk premium in other languages, please click the language menu on the right bottom. So, let us understand the. Less risky assets have lower returns. Although the definition of default risk may be fairly concrete, measurement of it is not. Check out the pronunciation, synonyms and grammar. It is commonly used in the case of bonds.

The possibility that a borrower will be unable to meet interest and/or principal repayment obligations on a loan agreement. Default risk premium is the added fee that a lender receives for the perceived chance that the borrower will not pay back the loan. This is the amount that a borrower has to pay to a lender to compensate them for assuming the risk of the borrower defaulting the other varieties of risk premium are dependent on their definitions and the specific situation. A default risk premium is built into every investment to cover this. We see it with people who have bad credit.

There are a variety of factors that determine creditworthiness, such. The capital asset pricing model is used to help. Adding a default risk premium. Proper citation formating styles of this definition for your bibliography. They are listed on the left below. Rrt is the rate of return of a risk free asset i.e. Risk premium calculator (click here or scroll down). It is the additional return that an investor requires to hold a risky asset rather than one that is risk free. Government bond, has a comparatively low rate of return because there is little or no risk of the u.s. Besides default risk premium, drp has other meanings. Rra is the rate of return of the asset you are investing in. The term the market in respect to stocks can be connoted as an. For example, the data necessary for its implementation are usually widely available at low cost, and its calculations are relatively simple.

Default Risk Premium Definition: Default premium is the component of interest rate that is attributed to the risk of the borrower failing to pay back the principal.

Source: Default Risk Premium Definition

0 Response to "Find Out 25+ Truths Of Default Risk Premium Definition They Missed to Share You."

Post a Comment